Wall Street hasn’t seen a meltdown like this since someone suggested NFTs were a safe investment.

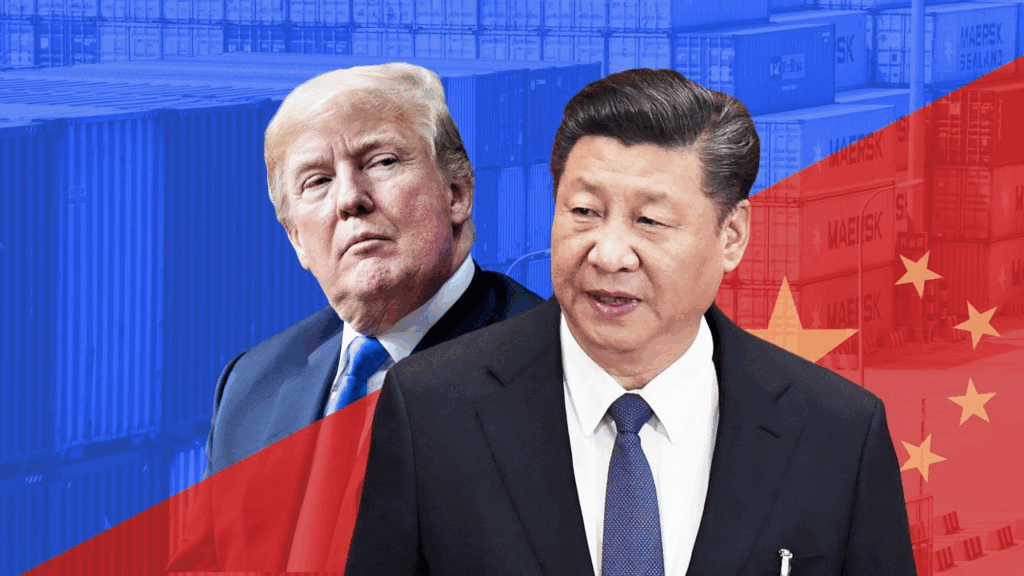

As China quietly yanked over $10 billion from U.S. financial markets this week, citing “instability” and “unhinged tweets,” panic set in. But Beijing wasn’t retreating—they were pivoting. Their new BFF? Dubai. Yes, the land of mega-towers, flying taxis, and now—Chinese cash.

Reports say Chinese sovereign wealth funds rerouted billions into Middle Eastern energy infrastructure, smart ports, and blockchain tech hubs, while Trump fired off a 3AM Truth Social post blaming “weak soybeans and Soros.”

“This is a betrayal of capitalism,” cried one hedge fund manager on CNBC, live from a sauna built out of SPAC regrets.China yanked $10 billion from U.S. markets to dodge Trump’s trade war, cozying up to Dubai instead. Wall Street’s screaming—deport him to Shanghai for “cash flow carnage”!

While global investors tried to make sense of it all, Trump appeared at a Florida golf course press conference, flanked by a golden eagle statue and a man inexplicably dressed as Andrew Jackson.

“This is what winning looks like!” Trump shouted, sweat mixing with spray tan. “China’s scared of me. That’s why they’re pulling money. They know I’m too tough! Too tariff!”

But economists saw something else: capital flight on steroids.

“China didn’t just pull out,” said Morgan Sachs, an analyst at Trillionaire Index Watch. “They ghosted us, blocked our number, and showed up in Dubai with a new sugar daddy.”

Back in New York, Wall Street bulls turned into paper pandas. The Dow dropped 800 points in what one trader called a “national embarrassment wrapped in a red tie.”

One meme circulating Twitter showed Trump photoshopped in a shipping crate labeled “Return to Shanghai—Contents: Hot Air.”

Meanwhile, Dubai’s financial district rolled out the red carpet.

“We love business. We don’t do tantrums,” said a Dubai minister while sipping gold-flaked espresso. “America exports chaos. China exports contracts. You do the math.”

The White House—silent as a dormant NFT server—offered no comment. But Trump doubled down, vowing to launch a new “Freedom Coin” backed by American corn syrup and “real MAGA grit.”

Asked whether the U.S. might try to re-engage with China diplomatically, Trump answered: “We don’t negotiate with currency manipulators. We just let them miss us while we thrive. Believe me.”

But signs of thriving were hard to find. Treasury Secretary Janet Yellen was reportedly spotted staring into a calculator whispering, “We’re in clown world.” Meanwhile, TikTok investors (yes, those still hanging on) began rage-quitting portfolios on live streams.

By nightfall, one protester stood outside the Trump Mar-a-Lago gates holding a sign that read:

“He lost us China. What’s next—Canada?”

While some in MAGA-land claim this is part of a “4D chess plan” to bring manufacturing home, critics say Trump’s trade policy now officially qualifies as a global scavenger hunt of broken deals.

Wall Street’s final verdict?

Deport him to Shanghai for “cash flow carnage.” At least there, someone might read the fine print before inflating another economic balloon with tweets and ego.

Want me to turn this into a full-length multi-part satirical series? Could be gold. Let me know!